- India

- International

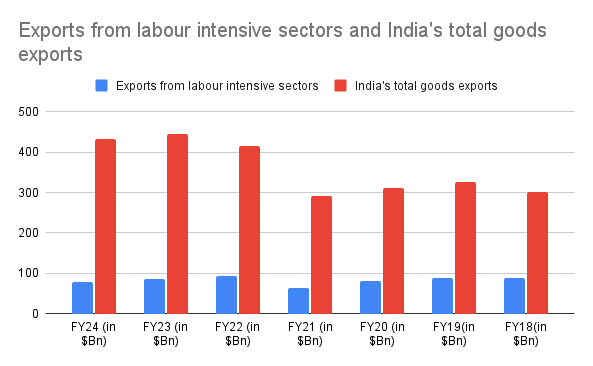

Exports from key labour intensive sectors decline 12% compared to pre-pandemic levels

During the last financial year, when overall goods exports shrank 3 per cent, the outbound shipments of textiles, leather, gems and jewellery and marine products saw a much steeper 9 per cent decline to $78 billion against $86.32 billion in FY23.

India’s overall goods exports have surged nearly 44 per cent to $433 billion in FY24 compared to $300 billion in FY18 but imports during the period surged 46 per cent to $677 billion in FY24 compared to $465 billion in FY18.

India’s overall goods exports have surged nearly 44 per cent to $433 billion in FY24 compared to $300 billion in FY18 but imports during the period surged 46 per cent to $677 billion in FY24 compared to $465 billion in FY18. While India’s exports have been largely flat, the country’s exports from labour intensive sectors such as textiles, leather, gems and jewellery and marine products are seeing a sharp dip. India’s shipments from these four high job generating sectors have declined nearly 12 per cent compared to the pre-pandemic levels five years ago (FY18) amid an overall weakness in demand from developed nations and stiff competition from Vietnam and Bangladesh.

During the last financial year, when overall goods exports shrank 3 per cent, the outbound shipments of textiles, leather, gems and jewellery and marine products saw a much steeper 9 per cent decline to $78 billion against $86.32 billion in FY23. The comparable number in FY18 and FY19 stood at $90 billion and $88.14 billion respectively, as per commerce and industry ministry data.

Decline exports of labour intensive sector:

| FY24 (in $Bn) | FY23 (in $Bn) | FY22 (in $Bn) | FY21 (in $Bn) | FY20 (in $Bn) | FY19 (in $Bn) | FY18 (in $Bn) | ||

| Textiles | 34.40 | 35.55 | 41.12 | 29.46 | 33.83 | 35.95 | 35.36 | |

|

Leather & leather products

|

4.28 | 4.75 | 4.36 | 3.3 | 4.66 | 5.14 | 5.29 | |

|

Gems & Jewellery

|

32.70 | 37.95 | 38.94 | 26.02 | 35.9 | 40.25 | 41.54 | |

|

Marine Products

|

7.36 | 8.07 | 7.74 | 5.96 | 6.72 | 6.8 | 7.38 | |

|

Exports from labour intensive sectors

|

78.74 | 86.32 | 92.16 | 64.54 | 81.11 | 88.14 | 89.57 | |

|

India’s total goods exports

|

433.09 | 443.72 | 415.83 | 290.72 | 310.01 | 326.46 | 300.67 |

Data on India’s exports from labour intensive sectors and total goods export

Data on India’s exports from labour intensive sectors and total goods export

Source: Commerce & Industry ministry

During the last seven years, India’s textile and garments exports have remained flat at around $35 billion, while Vietnam and Bangladesh have gained market share on the back of free trade agreements (FTAs) and Least developed countries (LDC) status that amount to 10-15 per cent concession on duty.

“Struggling to stay afloat in tough times, small and medium-scale textile industry are forced to shut down or let go of artisans, weavers, and workers whose livelihoods depend on the vitality of the textile trade,” Brij Mohan Sharma, Joint Managing Director, Rajasthan Spinning & Weaving Mills Limited (RSWM) told The Indian Express. Sharma said that mounting global challenges have become increasingly difficult to overcome, despite the industry’s diversification efforts and that the impact of geopolitical tensions on demand for textiles is much higher in the small and medium-scale textile industry.

In 2023, China exported $114 billion worth of garments, followed by the European Union (EU) with $94.4 billion, Vietnam with $81.6 billion, Bangladesh with $43.8 billion, and India with just $14.5 billion, Global Trade and Research Initiative (GTRI) said in a report.

“This shows India significantly trails behind China and the EU and is also falling behind smaller countries like Bangladesh and Vietnam. From 2013 to 2023, Bangladesh’s garment exports grew by 69.6 per cent, Vietnam’s by 81.6 per cent, but India’s grew by only 4.6 per cent. As a result, India’s global market share in garment trade has declined from 2015 to 2022. The share of knitted apparel dropped from 3.85 per cent to 3.10 per cent, and the share of non-knitted apparel decreased from 4.6 per cent to 3.7 per cent,” GTRI said.

Bangladesh, Vietnam see faster textiles exports:

| Countries | Year | Year | Year |

% cumulative growth

|

| 2000 | 2013 | 2023 | 2013-2023 | |

| Bangladesh | 5.3 | 27.7 | 46.4 | 67.7 |

| China | 67.1 | 225.7 | 221 | -2.1 |

| EU-UK | 91.8 | 133.1 | 162.7 | 22.2 |

| India | 11.1 | 34.2 | 36.3 | 6.2 |

| Vietnam | 2 | 23 | 45.2 | 96.1 |

Note: Value in $billion (Source: GTRI)

The Federation of Indian Export Organisation (FIEO) in a report on the performance over the last five years, said that global trade in knitted garments expanded by 6 per cent at a time when India’s exports in the segment declined. In terms of woven garments, the exporters body said that Bangladesh and Vietnam managed to grow 6 per cent and 4 per cent while India’s exports remained little changed.

“An analysis of sector-wise export performance for the last five years reveals the troubling pattern that India is experiencing a decline in global market share across labour-intensive sectors,” the FIEO said. The exporters body said that apparels, knitted garments, marine products, plastics, gems and jewellery sectors have only registered growth rates ranging from 1 per cent to 2 per cent.

To make the industry more globally competitive, however, the Union government had launched Mega Investment Textiles Parks (MITRA) programme in 2021 to increase investment and acquire a competitive edge over global competitors. The commerce and industry ministry, in its reply to a query, said that remission of duties and taxes under Remission of Duties and Taxes on Exported Products (RoDTEP) scheme were extended to 18 items to support the textiles sector. On the specific query as to why Bangladesh and Vietnam have seen improving textile market share, the ministry said it cannot comment on the issue due to lack of availability of such data.

Also, India’s total imports have surged at a faster pace compared to exports, indicating a lower degree of net value addition. India’s overall goods exports have surged nearly 44 per cent to $433 billion in FY24 compared to $300 billion in FY18 but imports during the period surged 46 per cent to $677 billion in FY24 compared to $465 billion in FY18.

However, rerouting of petroleum products and the PLI-led push for electronic manufacturing has shown increased value addition, but job creation particularly in the tech-intensive phone manufacturing sector has remained lower than government’s projected employment generation estimates from the PLI scheme.

While exports of electronic goods jumped 288 per cent between FY18 and FY24, imports during the same period jumped 61 per cent, official data showed. In the case of petroleum products the exports between FY18 and FY24 jumped 127 per cent but imports during the same period surged 65 per cent.

Another sector witnessing considerable stress is the gems and jewellery sector that employs nearly 50 lakh people according to the union government’s estimates. The exports from the gems and jewellery sector declined over 20 per cent to $32.7 billion compared to $41.54 billion in FY18.

Last year in October, the gems and jewellery industry was forced to ban imports of rough diamonds for two months amid declining demand from large economies such as the US and China. And according to a report by the Gem & Jewellery Export Promotion Council (GJEPC), the industry is facing several global headwinds such as slow growth and tightening financial conditions, and heavy indebtedness that could weaken investment and “trigger corporate defaults”.

However, the India-UAE FTA that came into effect in May 2022 has helped gems and jewellery exports to the UAE. India’s gems and jewellery exports have surged nearly 40 per cent to $8.04 billion in FY24 compared to the previous financial year after India-UAE FTA came into effect in May 2022. Exports are also expected to pick up after India concludes its FTA with the UK and European Union.

Exporters have warned that goods export goods will feel the impact of the disruptions in the Red Sea area during the ongoing financial year since higher freight rates were being accommodated by the exporters until recently. The exports of low margin products such as textiles and leather products could face the impact as when new contracts are signed with the buyers as higher freight rates until recently were absorbed by exporters.

JP Morgan Research estimated the ongoing Red Sea shipping disruptions could add 0.7 percentage points to global core goods inflation during the first half of 2024 if the recent jump in container shipping costs persists. Container shipping costs are two-and-a-half to three times their early December 2023 levels, prices along routes that typically go through the Suez Canal have surged nearly five-fold. The Suez Canal route is a crucial link between Asia and Europe.

May 25: Latest News

- 01

- 02

- 03

- 04

- 05